“But if they are fixed rate loan then of course you are locked in for a while. But ultimately, every other person going in for new loans now would have to brace themselves for higher rate because it will filter through to those rate in the market.”

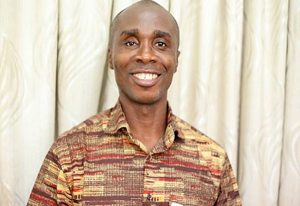

A Financial Analyst, Mr Courage Martey has said persons seeking new loans should prepare to pay higher rates following the increment in the policy rate from 19 per cent to 22 per cent by the Monetary Policy Committee (MPC) of the Bank of Ghana (BoG).

The ultimate effect of the upward adjustment of the Policy rate is that it will lead to increased cost of borrowing.

Speaking on the Ghana Tonight show with Alfred Ocansey on TV3 Wednesday August 17, he said “For loans already existing, if they are fixed rate loans you do not surfer anything, if they are flexible rate loan toed to some inflation rate or some 91 day bill plus some spread, then of course your loan obligation, interest cost is going higher.

“But if they are fixed rate loan then of course you are locked in for a while. But ultimately, every other person going in for new loans now would have to brace themselves for higher rate because it will filter through to those rate in the market.”

Speaking at the MPC’s emergency meeting in Accra on Wednesday August 17, the Governor of the BoG Dr Ernest Addison said recent developments in the foreign exchange market showed elevated demand pressures, reflecting among others, continued heightening of uncertainties in the global economy, rising inflation in many advanced economies and the resultant coordinated tightening of monetary policy stance by major central banks.

This, he added, has further tightened global financing conditions with significant implications for Emerging Markets and Developing Economies (EMDEs), especially for those with weak fundamentals.

The US Dollar has strengthened against all major currencies. From the beginning of the year to date, the pound sterling has weakened against the US dollar by 12.4 percent while the Euro has also weakened by 11.8 percent. Countries similar to Ghana (Ghana’s peers) are all experiencing sharp depreciation to date.

The Ghana Cedi, he noted, has depreciated by 25.5 percent year-to-date, reflecting the Ghanaspecific situation, including the challenging financing of the budget from both domestic and external sources, downgrading of sovereign credit rating, nonresidents disinvestment in local currency bonds, and loss of reserve buffers.

“The execution of the budget for the year has remained challenging. Revenue has not kept pace with projections and created financing challenges. In the absence of access to the international capital market and given the constrained domestic financing, central bank overdraft has helped to close the financing gap as reflected in the mid-year budget review. The Bank of Ghana is working with the Ministry of Finance to agree on a cap on the overdraft.

“Whilst addressing the immediate financing problems, the ongoing policy discussions with the IMF are expected to address the underlying

macroeconomic challenges, restore fiscal and debt sustainability, and provide sustainable balance of payments cushion.

“Under the circumstances, and considering the risks to the inflation outlook, the Committee decided on a 300 basis points increase in the Monetary Policy Rate to 22 percent.”

3news