GOIL’s earnings per share drop to GHS 0.10 in Q2 2023 as net profit declines

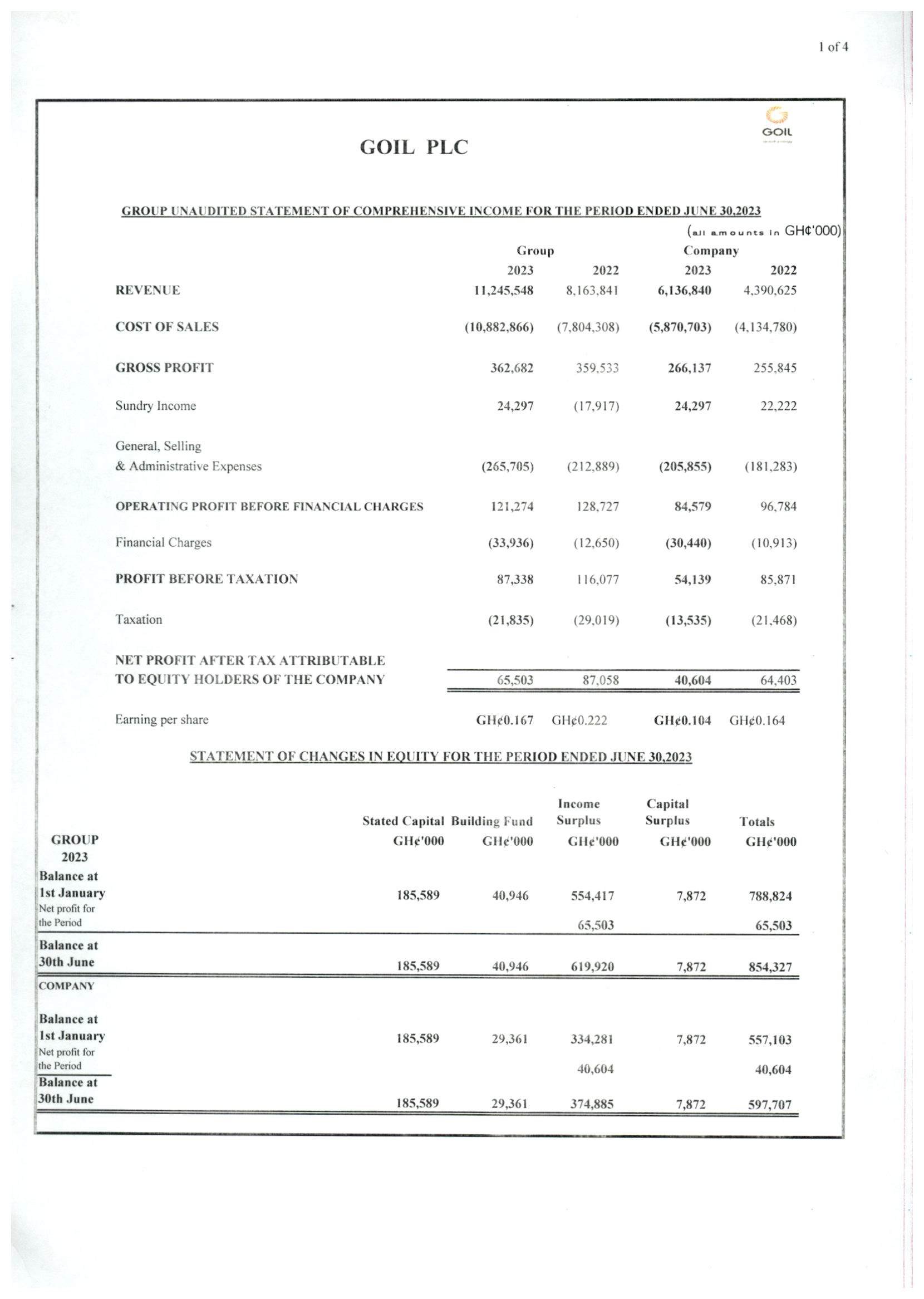

At the close of the second quarter of 2023, net profit posted by GOIL and attributable to shareholders stood at GHS 40.6m, a significant decline from the GHS 64.4m recorded same period last year.

The slide in net profit earnings was despite an uptick in revenue from GHS 4.39 billion in Q2 2022 to GHS 6.13 billion in Q2 2023.

Cost of sales, administrative expenses and financial charges which rose to GHS 5.87bn, GHS 205m and GHS 30.4m respectively, accounted for the decline in net profit at end-Q2 2023.

The net profit earnings contraction as noted in the company’s financial statement, impacted the company’s earnings per share (EPS) metric, which retreated from GHS 0.16 in the preceding year to GHS 0.10 in Q2 2023.

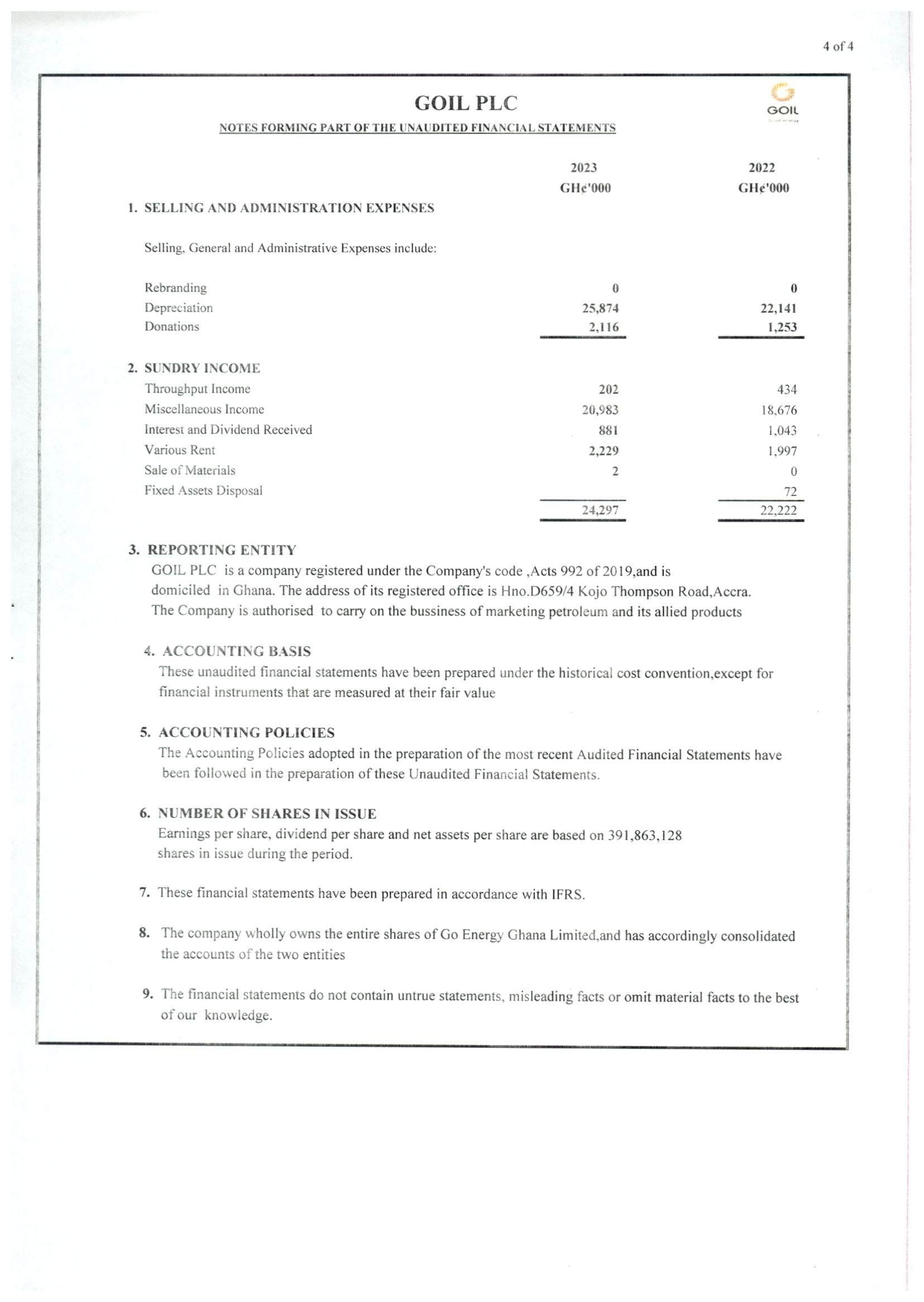

Within the review period, GOIL’s assets value showed a slight rise. The aggregate assets value reached GHS 3.63 billion at the close of Q2 2023, up from the previous year’s figure of GHS 3.25 billion.

This increment can be traced to the bolstering of both current and non-current assets, which culminated at GHS 2.07 billion and GHS 1.56 billion respectively.

On the flip side, liabilities of the Oil Marketing Company (OMC) expanded, ascending from GHS 2.70 billion in Q2 2022 to GHS 3.03 billion in Q2 2023, driven largely by increments in its current liabilities.

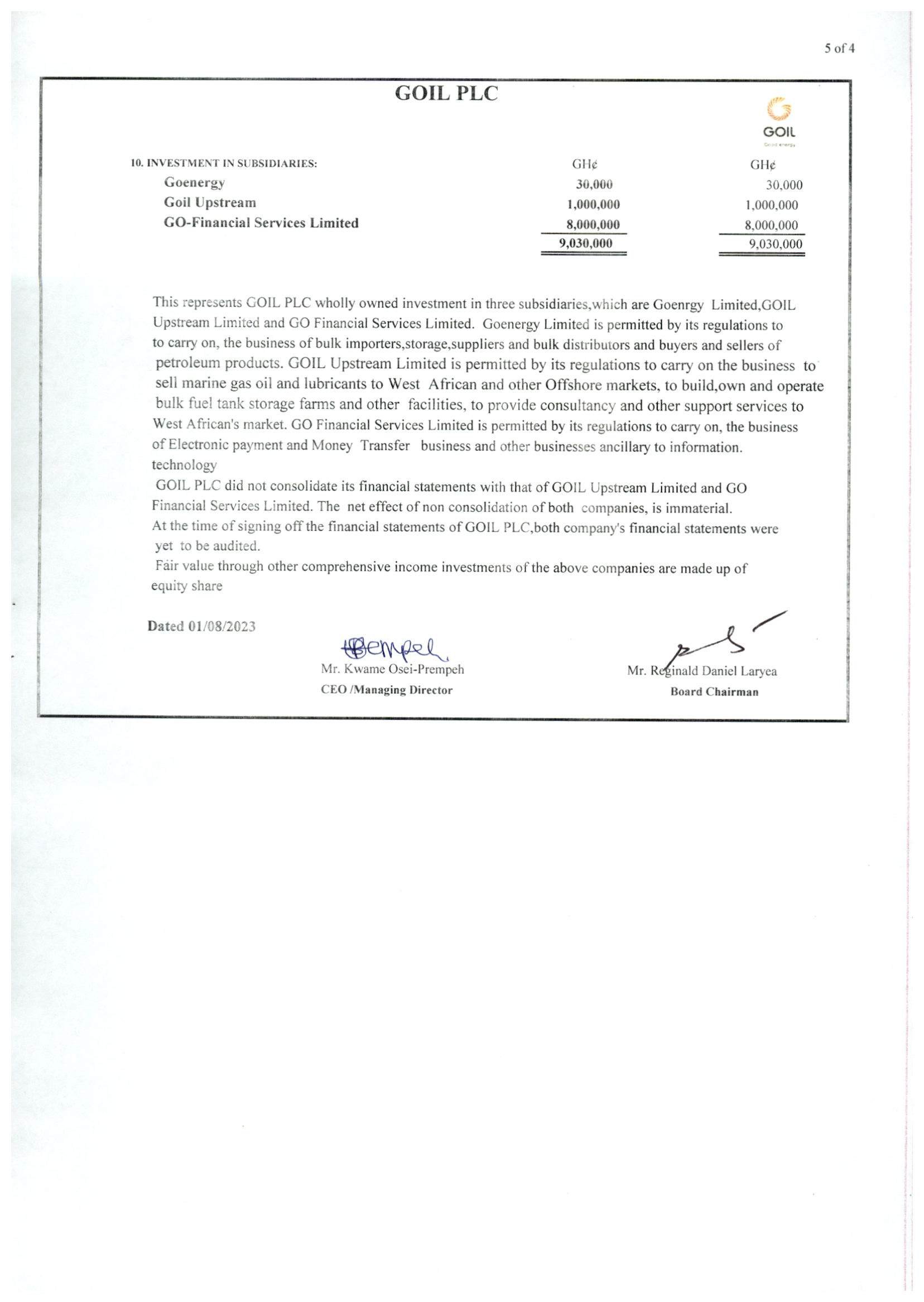

GOIL’s financial performance in Q2 2023 paints a complex picture of a company navigating the currents of increased revenue generation, yet grappling with amplified costs and obligations. The juxtaposition of these factors has culminated in a dip in its net profit and EPS and an increase in its liabilities.

Read details of financial statement below:

Ashantibiz